unlevered free cash flow enterprise value

Free cash flow of a firm Earning for shareholders Redemption of capital - Issue of fresh capital Increase in. It is the inverse of the Free Cash Flow.

Free Cash Flow Yield Formula And Calculator

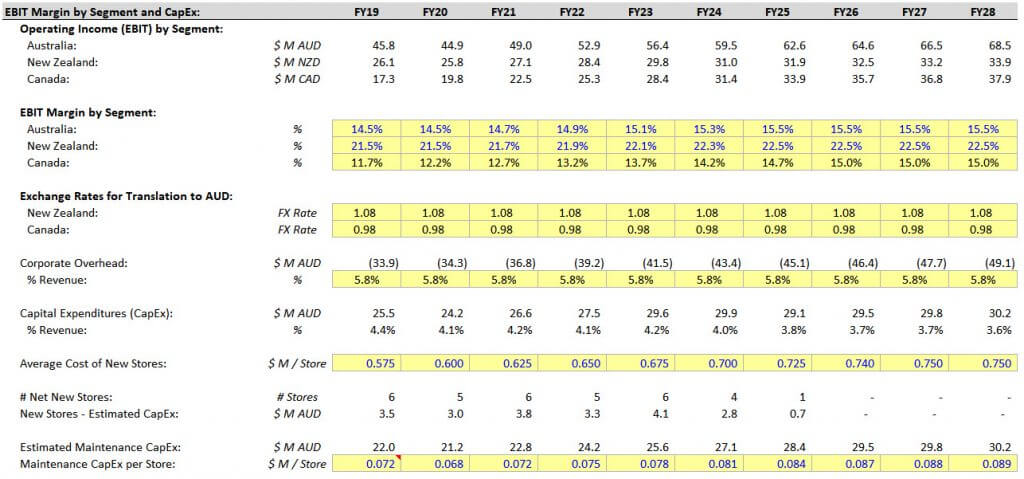

In practice a companys unlevered free cash flow is most.

. Unlevered free cash flow is used in DCF valuations or debt capacity analysis in highly leveraged transactions to establish the total cash generated by a business for both debt and equity. Unlevered free cash flow is important. Universal Robinas latest twelve months unlevered free cash flow yield is -01.

View RFM Corporations Unlevered Free Cash Flow Yield trends charts and more. Unlevered free cash flow UFCF is the cash generated by a company before accounting for financing costs. Unlevered free cash flow UFCF is the cash flow available to all providers of capital including debt equity and hybrid capital.

10252016 Hi everybody I just read that unlevered FCF gives the Enterprise Value and unlevered FCF are before Interest. Like levered cash flows you can find unlevered cash flows on the balance sheet. Unlevered FCF Enterprise Value Originally Posted.

UFCF EBITDA - Capital expenditures CAPEX -. View Universal Robina Corporations Unlevered Free Cash Flow Yield trends charts and more. Unlevered free cash flow corresponds to enterprise value ie.

RFMs latest twelve months unlevered free cash flow yield is 02. Get the tools used by smart 2. Enterprise Value to Free Cash Flow compares the total valuation of the company with its ability to generate cashflow.

Whereas levered free cash flows can provide an accurate look at a companys financial health. Unlevered Free Cash Flow - UFCF. A business or asset that generates more cash than it invests.

The value of a companys core operations to all capital providers. Unlevered free cash flow. How to calculate unlevered free cash flow.

Unlevered free cash flow UFCF is used at a high level to determine the enterprise value of a business. This metric is often represented on the companys financial statements but analysts also calculate this enterprise value manually. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account.

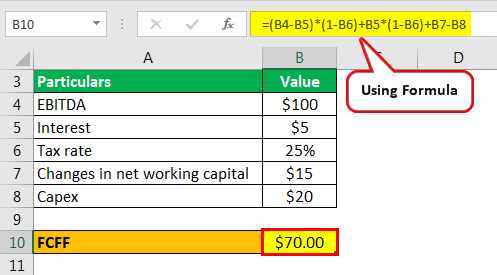

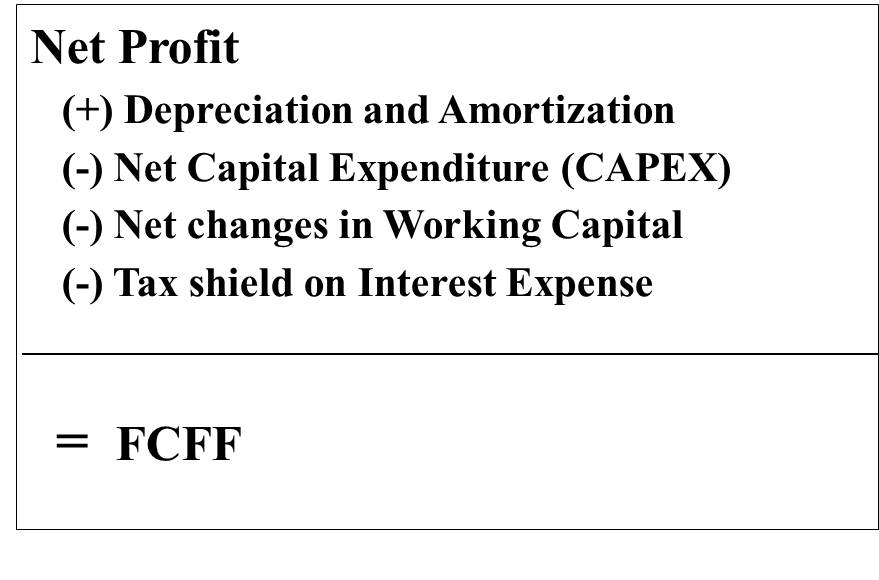

10 Y A F C F 10 -Year average free cash flow O S Outstanding shares O Options W Warrants P S P Per share. The formula of free cash flow of a firm is given below. When calculating UFCF you consider EBITDA.

This metric is most useful when used as part of the discounted cash flow. The average consumer may not ever see or need to know this. Unlevered free cash flow formula.

Stockopedia explains EV FCF. 10 Y A F C F O S O W P S P L C A I where.

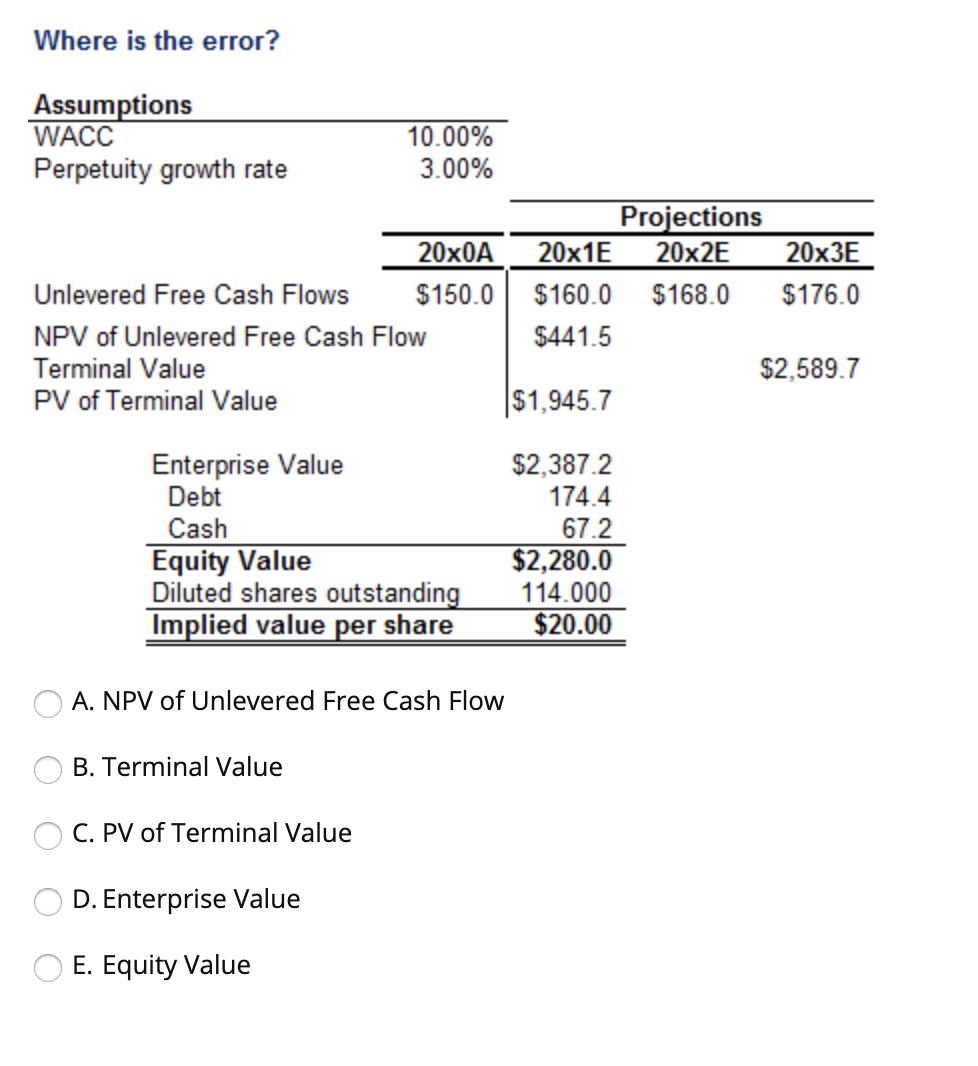

Solved Where Is The Error Assumptions Wacc Perpetuity Chegg Com

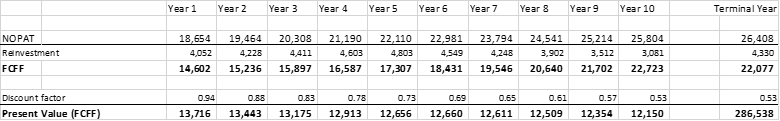

Building A Dcf Using The Unlevered Free Cash Flow Formula Fcff

Business Valuation Models Two Methods 1 Discounted Cash Flow 2 Relative Values Ppt Download

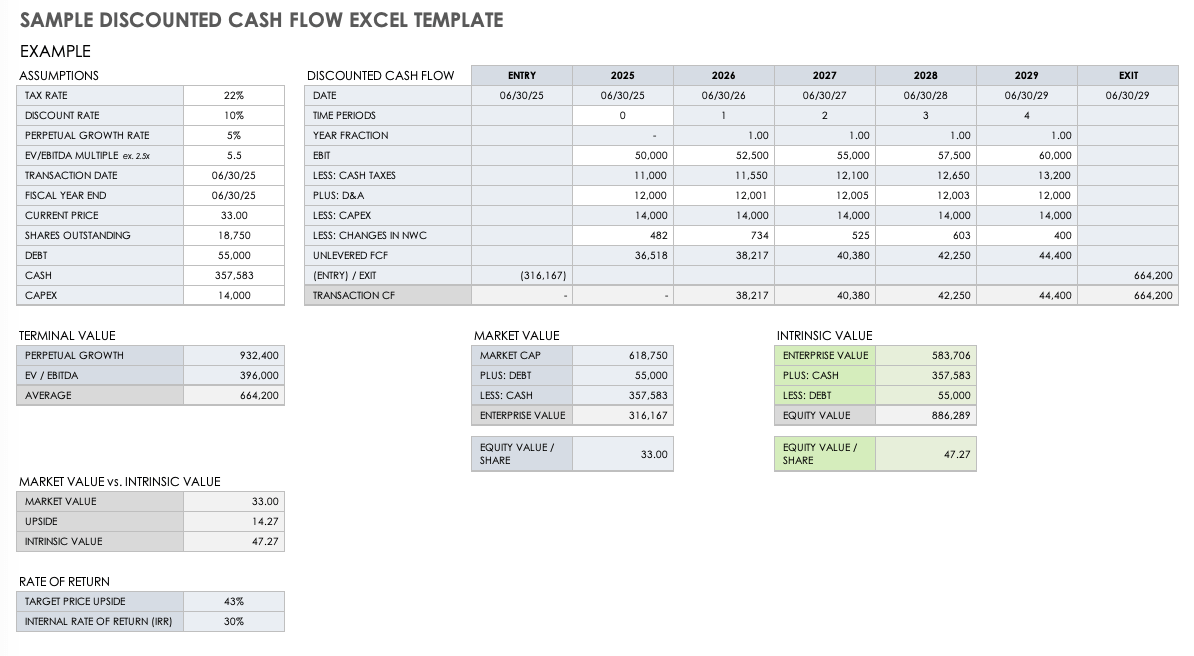

Free Discounted Cash Flow Templates Smartsheet

Discounted Cash Flow Analysis Street Of Walls

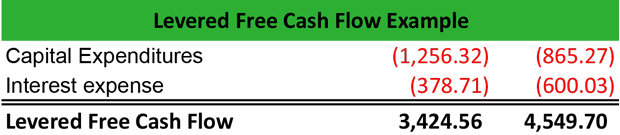

What Is Levered Free Cash Flow Definition Meaning Example

Enterprise And Equity Value In Dcf Financial Model Keyskillset

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Fcff Vs Fcfe Top 5 Useful Differences With Infographics

Discounted Cash Flow Analysis Street Of Walls

Terminal Value In Dcf How To Calculate Terminal Value

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow Levered And Unlevered Free Cash Flow Bankingprep

Free Cash Flow Yield Formula Top Example Fcfy Calculation

How To Calculate Unlevered Free Cash Flow In A Dcf

Understanding The Differences Between Levered And Unlevered Free Cash Flow Article

What Is Levered Free Cash Flow Definition Meaning Example

Unlevered Free Cash Flow Definition Examples Formula Wall Street Oasis

Enterprise Value Vs Equity Value Complete Guide And Excel Examples